The B2B transactions need financial clarity and control for profitability and smooth operations. Several factors affect these transactions.

One of the noteworthy entities that impact profitability is a chargeback. Let’s understand- What are chargebacks, what factors affect them, why are they important, and how can one formulate, study, interpret, and leverage chargebacks for enhancing margins?

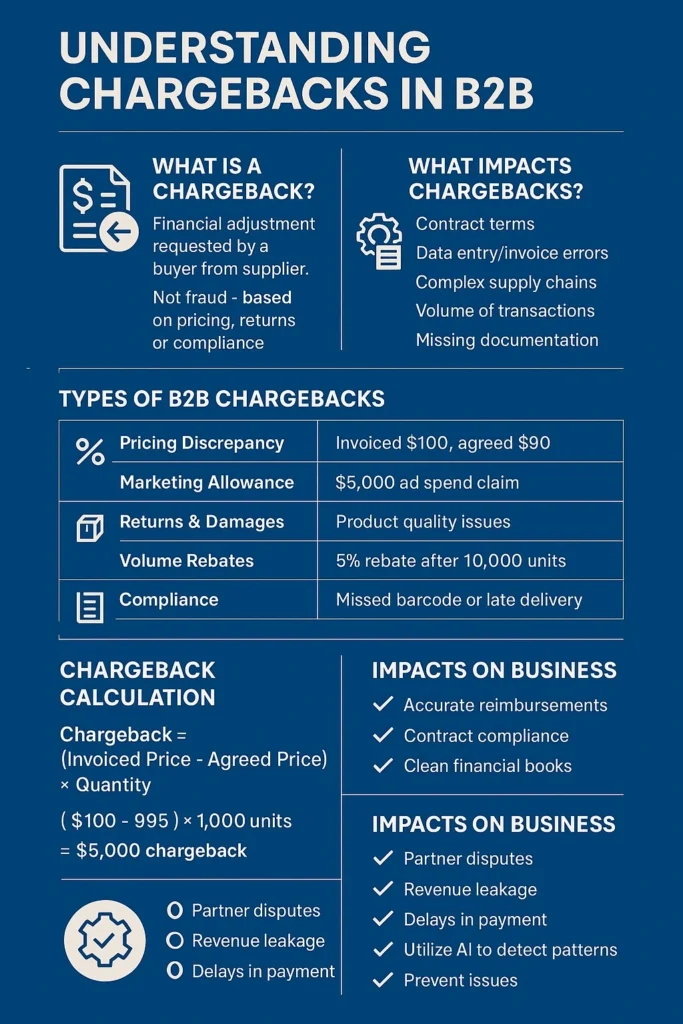

What is a Chargeback in the B2B Context?

A B2B chargeback refers to a financial transaction adjustment initiated by a buyer, distributor, wholesaler, or retailer requesting reimbursement from a supplier or manufacturer.

These are usually not due to fraud or payment issues, as in B2C. They are a result of pre-agreed conditions such as promotional pricing, volume discounts, contract terms, or compliance errors.

In essence, a chargeback is a method for reconciling financial differences when the buyer believes they’ve overpaid or didn’t receive what was promised.

Types of Chargebacks in B2B

Here are the most common types of chargebacks in the B2B environment:

1. Pricing Discrepancy Chargebacks:

These chargebacks are often a result of a mismatch between the invoiced price and the price agreed upon in a contract, promotion, or deal sheet. Example: A distributor was promised a promotional price of $90 per unit but was invoiced at $100. The $10 per unit difference is charged back to the supplier.

2. Promotional or Marketing Allowance Chargebacks:

They occur when buyers invest in promoting a supplier’s product (e.g., retail placement, flyers, digital ads) and claim back the agreed-upon marketing costs. Example: A retailer agrees to run a campaign for a supplier’s product worth $5,000. Once completed, the retailer charges back that amount for reimbursement.

3. Tier-Based Chargebacks:

They come into the picture when the buyer qualifies for a rebate or discount based on reaching a sales volume threshold and seeks reimbursement for the excess amount paid. Example: A wholesaler crosses the 10,000-unit mark for a product, qualifying for a 5% rebate. They may issue a chargeback for that amount if invoiced at a higher rate.

4. Product Returns/Damaged Goods Chargebacks:

They are applied when products are returned due to damage or expiry, or non-compliance with specifications. Example: A shipment arrives with 5% of the goods damaged. The buyer may return them and issue a chargeback for the corresponding value.

5. Compliance Chargebacks:

They are imposed when the supplier fails to meet logistical or documentation requirements, such as incorrect labeling, late delivery, or incomplete shipping paperwork. Example: A supplier sends goods without the correct barcode or packing slip. The retailer may apply a penalty chargeback, as outlined in their compliance guide.

What Factors Impact Chargebacks?

Several factors contribute to the frequency and complexity of chargebacks:

- Contract terms: Ambiguities in pricing, delivery, or promotional conditions can lead to disputes.

- Data accuracy: Errors in invoice generation or EDI(Electronic Data Interchange) can trigger chargebacks.

- Volume and frequency of transactions: High-frequency trading increases the likelihood of errors.

- Product lifecycle stage: New or promotional items are more prone to chargebacks due to dynamic pricing and aggressive marketing campaigns.

- Supply chain complexity: Multi-tier supply chains with numerous touchpoints often result in greater reconciliation challenges.

- Documentation errors: Missing or incorrect delivery slips, barcodes, or shipping labels can lead to compliance-related chargebacks.

How Are Chargebacks Calculated?

The calculation depends on the type of chargeback and contractual agreements. Here’s a general process:

- Identify the discrepancy: Compare the actual invoice or delivery against the agreed terms.

- Determine quantity or the number of units impacted: Is the issue product-specific, volume-related, or percentage-based?

- Apply rate of adjustment: This could be a fixed amount, a percentage, or a penalty rate.

- Generate the chargeback claim: contracts, delivery receipts, and promotional agreements help generate them.

- Submit for approval: Sent to the supplier through automated systems or manually, depending on the organization.

Example: A distributor received 1,000 units of a product at $100 per unit. The agreed promo rate was $95.

So, the chargeback = (100 – 95) × 1,000 = $5000

How Can Chargebacks Impact Businesses?

Chargebacks have a huge impact on businesses.

Ineffective management of chargebacks can result in operational inefficiencies, delayed payments, a loss of trust between partners, revenue leakage, increased compliance fees, and financial disputes. and even reduced profitability. Retail and pharmaceutical manufacturing lose millions annually due to poor management of chargebacks.

When handled properly, chargebacks help ensure accountability, fair pricing, accurate promotional spend tracking, operational efficiency, enhanced margins, and profitability.

Best Practices to Manage and Optimize Chargebacks

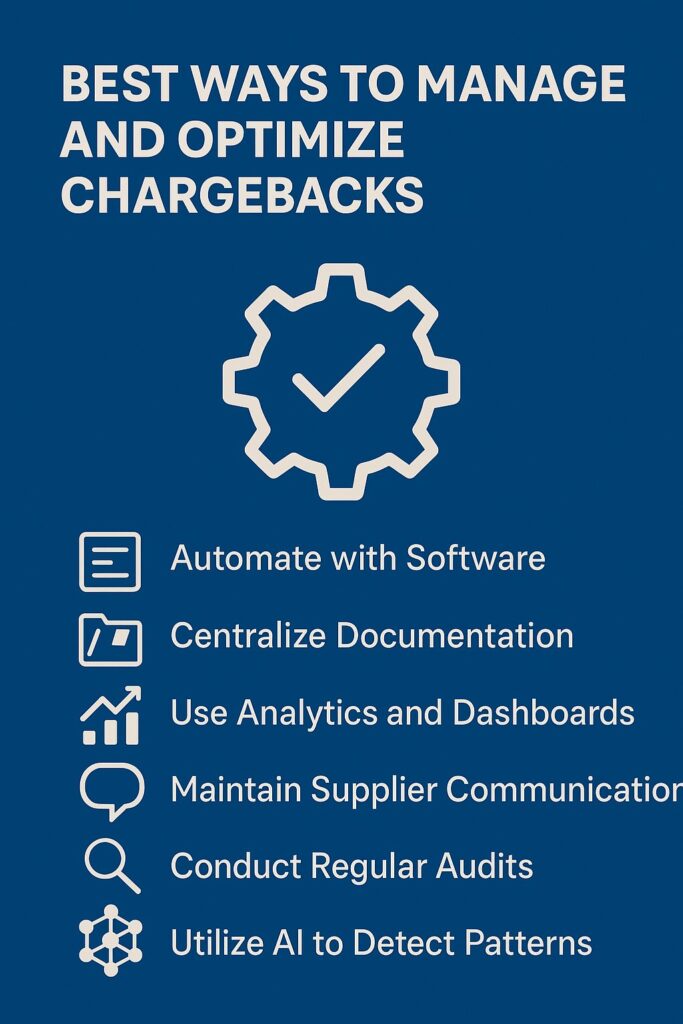

- Automate chargeback processing:

It is advisable to leverage software solutions to automate the matching of invoices and contracts. This reduces errors and accelerates approvals. This is where the chargeback management and optimization software from IMA360 can help. It is powered by AI, and it automates the calculation of chargebacks, removing the errors that can happen due to manual calculation. It also keeps a track record of all the transactions, provides real-time insights, and saves productive time for teams to enhance efficiency and margins.

- Centralize the documentation:

Maintain a single source of truth for contracts, promotional deals, and compliance requirements.

- Invest in analytics:

Use dashboards to identify recurring chargeback reasons and high-impact vendors or customers.

- Improve communication:

Foster proactive dialogue between supplier and buyer teams to clarify terms, timelines, and expectations.

- Audit regularly:

Periodic audits help identify process loopholes, overcharging, or underpayments.

- Enforce compliance:

Suppliers should be educated about your compliance manual and penalized appropriately for repeated violations.

- Use AI-driven platforms:

AI tools can detect patterns, predict potential chargebacks, and recommend corrective actions before disputes occur. The AI suite of solutions from IMA360 helps analyze which chargebacks are working best for the business and which aren’t. It also helps study and analyze the latest trends in the chargeback calculation in a B2B setup.

Conclusion

Chargebacks are an inevitable but manageable aspect of B2B operations. When handled transparently and systematically, they help both buyers and suppliers maintain accountability and financial integrity. However, if left unchecked, chargebacks can become a source of friction, revenue leakage, and operational burden.

To stay ahead, B2B organizations must invest in automation, adopt data-driven strategies, and foster collaborative relationships. By optimizing chargeback processes, companies can unlock better margins, improved compliance, and stronger partnerships.

Deepak Bhardwaj has 10 years of experience advocating AI for profit and revenue optimization, data security, and analytics.

He has partnered with customers in USA, UK, and the APAC region to help them with suitable AI solutions as per their needs.